7 AI-Powered Finance Tools That Will Manage Your Money for You

7 AI-Powered Finance Tools That Will Manage Your Money for You 7 AI-Powered Finance Tools That Will Manage Your Money for You Managing your finances no longer requires spreadsheets, calculators, or even willpower. In 2025, AI-powered finance tools are changing the game—analyzing your habits, automating your savings, and making smarter money decisions for you. Whether […]

How Gen Z Is Budgeting Differently in 2025 (and What You Can Learn)

How Gen Z Is Budgeting Differently in 2025 (and What You Can Learn) In 2025, Gen Z is redefining how we think about money. While older generations clung to spreadsheets and rigid monthly budgets, Gen Z is ditching tradition for flexible, digital-first approaches that better match their fast-paced, high-inflation reality. Their strategies aren’t just novel—they’re […]

Side Hustles That Still Work in 2025 (And Which Ones to Avoid)

Side Hustles That Still Work in 2025 (And Which Ones to Avoid) The side hustle economy is alive and well in 2025—but it’s evolved. What worked in 2020 doesn’t always fly today. Thanks to AI, automation, and shifting consumer habits, some gigs have grown into goldmines… while others have fizzled out. Whether you’re looking to […]

Why Your Emergency Fund Needs to Be Bigger in 2025

Why Your Emergency Fund Needs to Be Bigger in 2025 In the past, a 3-month emergency fund was considered enough. But in 2025, that rule of thumb is outdated. Between rising costs of living, job market shifts, and unpredictable global events, your financial safety net needs a serious upgrade. Here’s why it’s time to rethink […]

How I Paid Off $50K in Debt Using Just 2 Apps

Paying off $50,000 in debt felt like climbing Everest without oxygen. But what if I told you I did it using only two simple apps—no complicated spreadsheets or expensive advisors? In this article, I’ll share exactly which apps transformed my financial life and how you can use them to crush your debt too. 💡 The […]

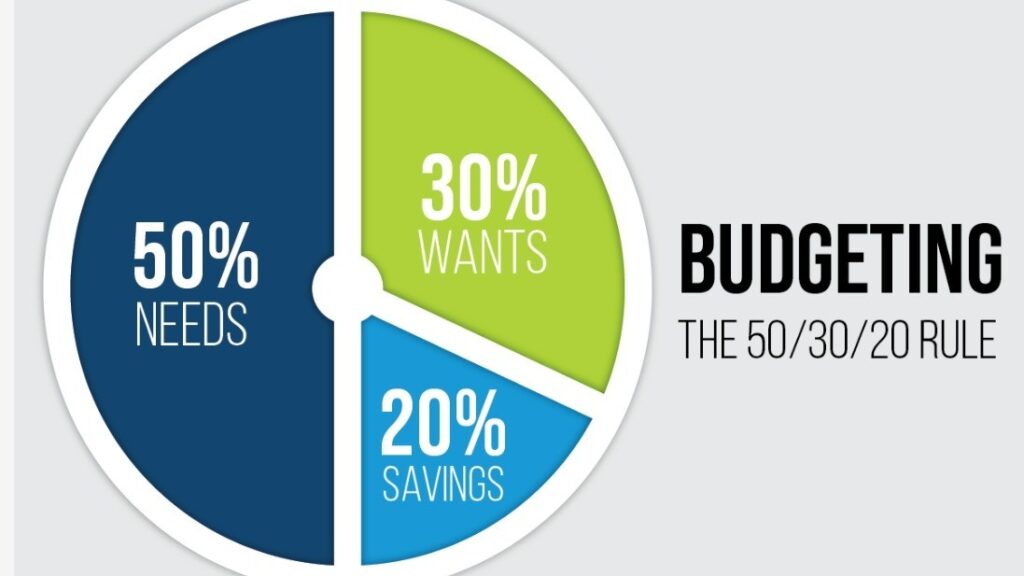

The New 50/30/20 Rule: Budgeting When Everything Costs More

The classic 50/30/20 budgeting rule has helped millions balance needs, wants, and savings. But in 2025, with inflation surging and everyday expenses climbing, that old formula needs a serious update. Here’s how to tweak the 50/30/20 rule to work when everything costs more — so you can still save, enjoy life, and stay financially sane. […]

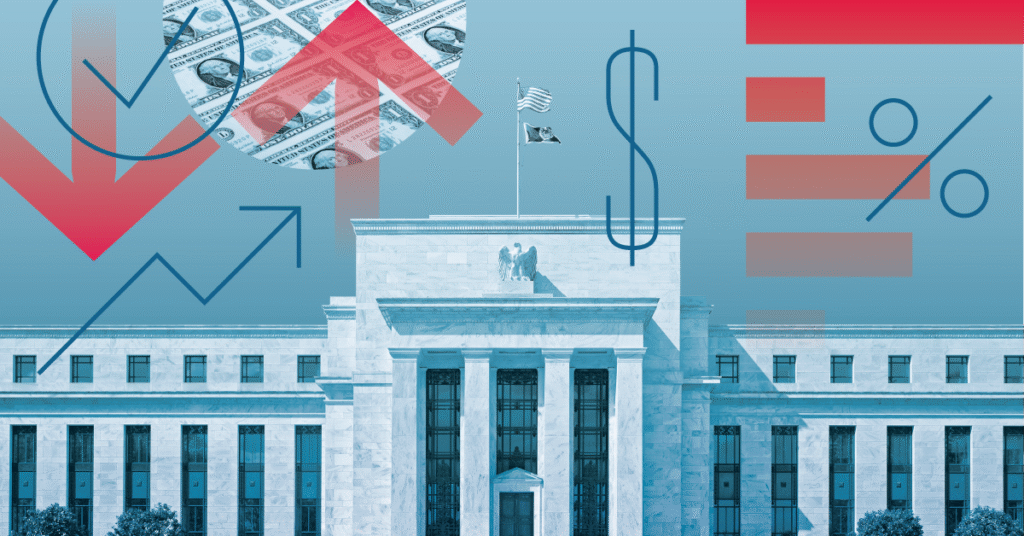

What the Fed’s 2025 Moves Mean for Your Savings Account

The Federal Reserve’s decisions in 2025 are reshaping the landscape for savers. With interest rates fluctuating and economic uncertainties on the horizon, it’s crucial to understand how these changes impact your savings and how you can adapt to maximize returns. 📉 The Fed’s Current Stance As of mid-2025, the Federal Reserve has maintained its benchmark […]

Crypto’s Not Dead: 3 Places Gen Z Is Still Investing in 2025

Despite the volatility and skepticism surrounding cryptocurrencies, Generation Z remains steadfast in their belief in digital assets. In fact, over half of Gen Z globally own or have owned cryptocurrency, according to a 2025. 1. Bitcoin (BTC): The Digital Gold Standard Bitcoin continues to be the flagship cryptocurrency for Gen Z investors. Its reputation as […]

Cash Is Cool Again: Why More People Are Going Analog With Their Money

In an era dominated by digital payments, the resurgence of cash might seem counterintuitive. Yet, in 2025, more individuals are opting for physical currency to manage their finances. This shift is driven by a combination of economic factors, technological considerations, and personal preferences. 💸 The Return of Cash 1. Economic Uncertainty and Budgeting With inflation […]

AI Money Coaches vs. Humans: Which One Really Saves You More?

When it comes to managing your money, you might wonder: Should I trust an AI-powered money coach or a human financial advisor? Both promise to help you save, invest, and grow your wealth, but which one actually delivers better results in 2025? Let’s break down the pros and cons to see which option can save […]