The classic 50/30/20 budgeting rule has helped millions balance needs, wants, and savings. But in 2025, with inflation surging and everyday expenses climbing, that old formula needs a serious update.

Here’s how to tweak the 50/30/20 rule to work when everything costs more — so you can still save, enjoy life, and stay financially sane.

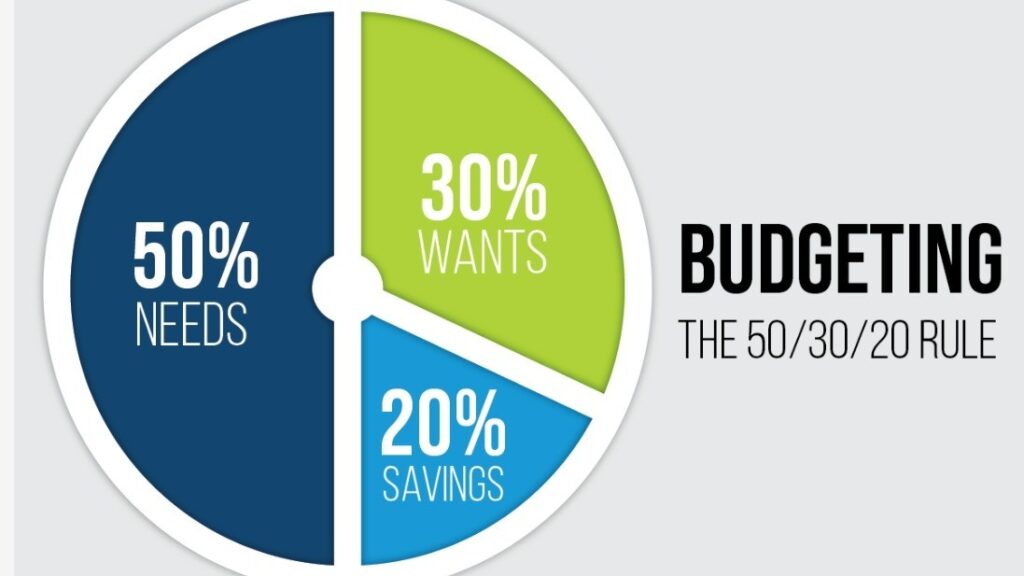

🔍 What Was the Original 50/30/20 Rule?

- 50% on Needs (rent, groceries, utilities)

- 30% on Wants (dining out, entertainment, travel)

- 20% on Savings & Debt Repayment

This worked well when prices were relatively stable and predictable.

🚨 Why the Old Rule Doesn’t Fit 2025

- Rent and housing costs have skyrocketed

- Food and fuel prices are up significantly

- Utilities and insurance premiums are higher

- Debt levels remain stubbornly high

Many people find their “Needs” slice is now 60% or more of take-home pay, squeezing their budget and saving goals.

💡 The New 50/30/20 Rule: Adjusted for Today’s Costs

1. Needs: 60%

Prioritize essentials, but also look for savings: use AI apps to track bills, cancel unused subscriptions, and shop smarter.

2. Wants: 15%

Cut back on discretionary spending without cutting out joy. Prioritize meaningful experiences or affordable hobbies.

3. Savings & Debt: 25%

Raise your savings rate by automating transfers and tackling high-interest debt aggressively.

🔧 Tips to Make This Work

- Track Every Dollar: Use budgeting apps like YNAB or Emma to visualize where money goes

- Automate Savings: Set up AI-powered tools like Plum or Digit to save effortlessly

- Meal Prep & Shop Sales: Small food savings add up fast

- Negotiate Bills: Services like Truebill can lower recurring expenses

🚀 Why Adjusting Your Budget Is Crucial

Failing to adapt means living paycheck to paycheck, missing savings goals, or falling deeper into debt.

But the good news? With smart budgeting and tech tools, you can still balance rising costs while building financial security.

Final Thought: Budget Smarter, Not Harder

2025 demands a new mindset about money. The new 50/30/20 rule isn’t just about percentages—it’s about flexibility, automation, and making your money work harder for you.

Author: AI Generated